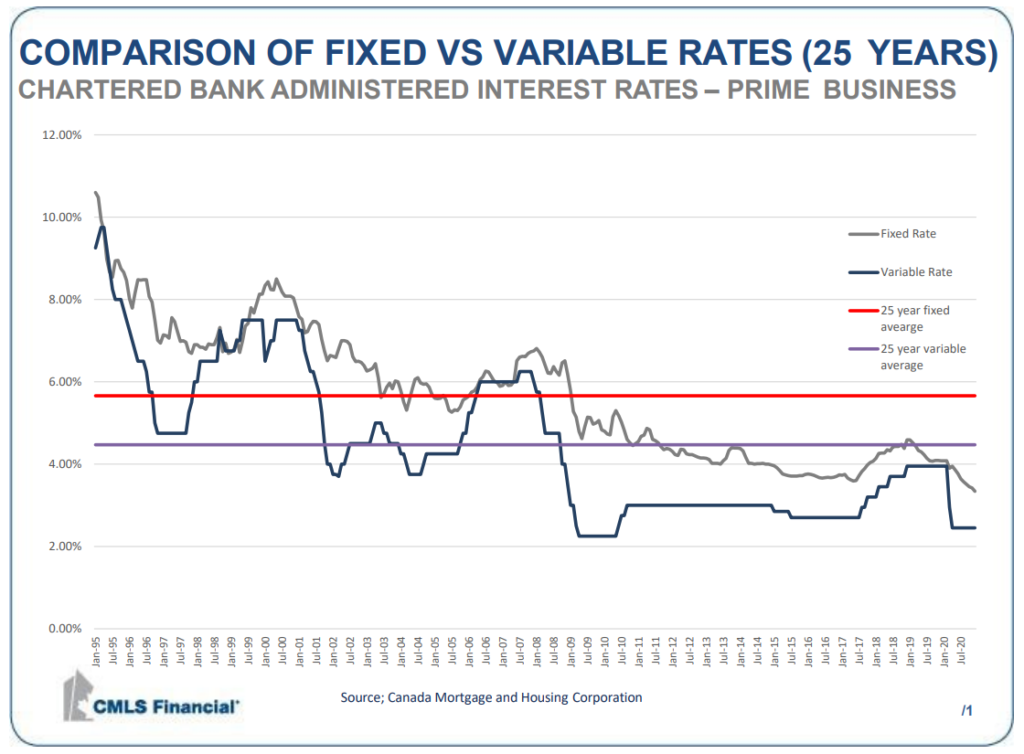

23 Nov COMPARISON OF FIXED VS VARIABLE RATES OVER THE SPAN OF 25 YEARS

What is a fixed-rate mortgage?

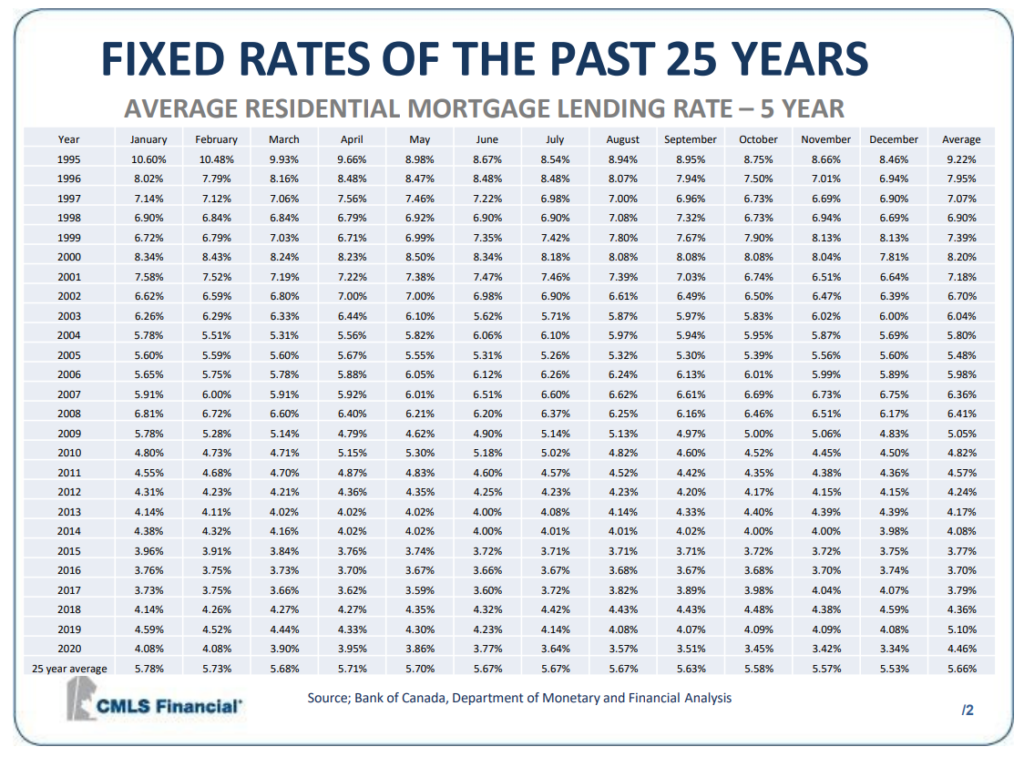

With fixed-rate mortgages, your interest rate stays the same for the length of your term. It doesn’t matter if interest rates go up or down. The interest rate on your mortgage won’t change, and you’ll pay the same amount every month. Fixed-rate mortgages typically have a higher interest rate compared to variable-rate mortgages because they guarantee a consistent rate.

What is a variable-rate mortgage?

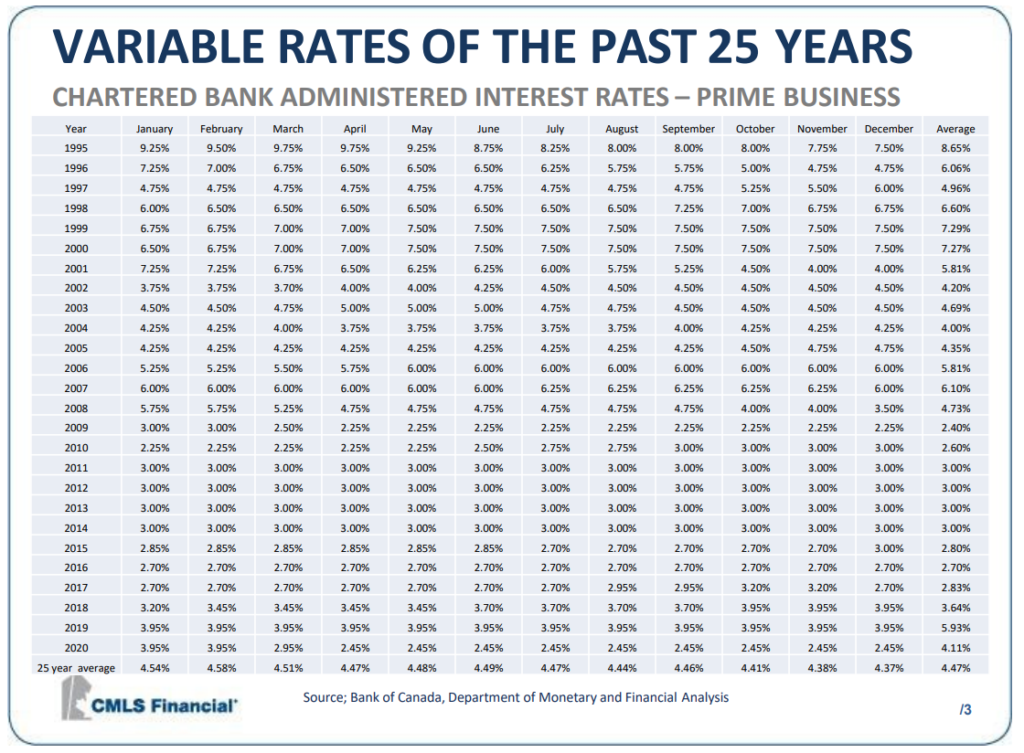

Variable-rate mortgages are appealing because the interest rates are typically lower than those on fixed-rate mortgages. If interest rates fall during your term, your mortgage interest rate will too — and the amount of interest you pay will decrease.

A variable-rate mortgage typically offers an interest rate tied to the lender’s prime rate, which is usually tied to the Bank of Canada’s prime rate. Let’s say you’ve signed a mortgage for the prime rate -0.50%. Your lender currently has a posted prime rate of 2.50%, so you’ll pay 2% interest. If the prime rate were to fall to 2.25%, your interest rate would be 1.75%. However, if the prime rate went up to 2.75%, your interest rate would increase to 2.25%.

Sorry, the comment form is closed at this time.